Trade talks between the United Kingdom and Canada fell apart late last month.

The U.K. raised concerns with Canada’s new 245 percent tax levied on British cheese (effective January 1 this year), while Canada wanted changes to U.K. health rules to allow for hormone-treated beef.

Whatever one thinks about the merits of either country’s position, the breakdown was disappointing and is hopefully soon corrected.

Canada has long been a small, open economy. Our trade relationships are among the most important economic assets we have.

Trade plays a crucial role in our economy, especially for the agriculture and resource sectors, which are inherently export-oriented, and for manufacturing, which is deeply integrated with global supply chains. Imports are no less important. From computers to clothing, suppliers elsewhere provide much of what we need.

And the importance of trade has only grown. Trade was equivalent to between 30 percent and 40 percent of our economy for a century after Confederation (with a brief spike during the First World War). But in recent decades trade volumes took off, reaching a high of more than three-quarters of our economy by 2000 before declining slightly to settle in at the roughly two-thirds we have today.

Agreements with the United States, various treaties under the WTO, the rise of China, the fall of the Soviet Union, and new trade deals with Europe through CETA and Pacific countries through the TPP all played a part.

But despite this extensive liberalization, Canada’s trade is large with one partner: the U.S. Roughly 80 percent of all our exports go to the U.S. That’s a very risky strategy, especially given how lopsided the relationship is.

From our perspective, we have no greater partner. From theirs, it’s an entirely different story.

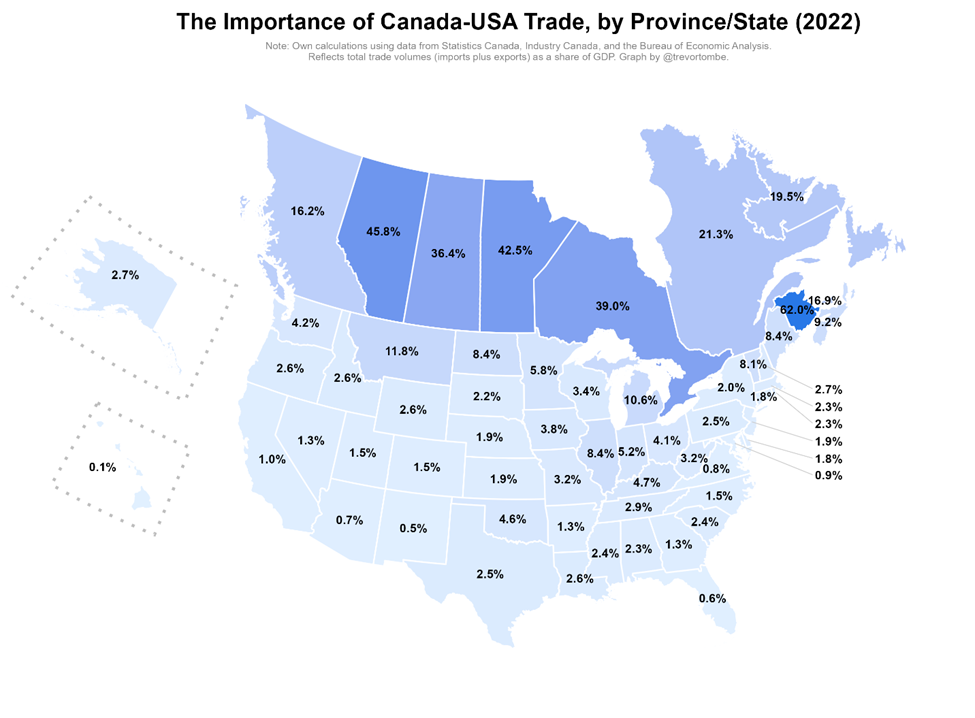

Consider this: total trade between Canada and the U.S. represents a significant portion of economic activity for every single province but is barely more than a blip for most U.S. states.

Trade with the U.S. is 46 percent of Alberta’s economy, 43 percent of Manitoba’s, 39 percent of Ontario’s, and more than 62 percent of New Brunswick’s.

But look at the U.S. Michigan’s economy, at the high end, is less than 11 percent dependent on trade with Canada. Among the most populous states, it barely registered, accounting for merely 1 percent of California’s GDP, 2 percentof New York’s, 0.6 percent of Florida’s, and 2.5 percent of Texas’.

Overall, Canada-U.S. trade is roughly 3 percent of the U.S. economy. For Canada, it’s roughly one-third.

This matters for the political and policy calculus that leaders south of the border make. There are far fewer consequences for businesses and consumers down there from any disruption, so the incentive to ensure free trade continues is far less. We saw significant risks to the trading relationship under the former U.S. president, for example, and protectionist inclinations have continued, even grown, under the current one.

Whoever wins this year’s election, Canada faces trade risks that few other countries do.

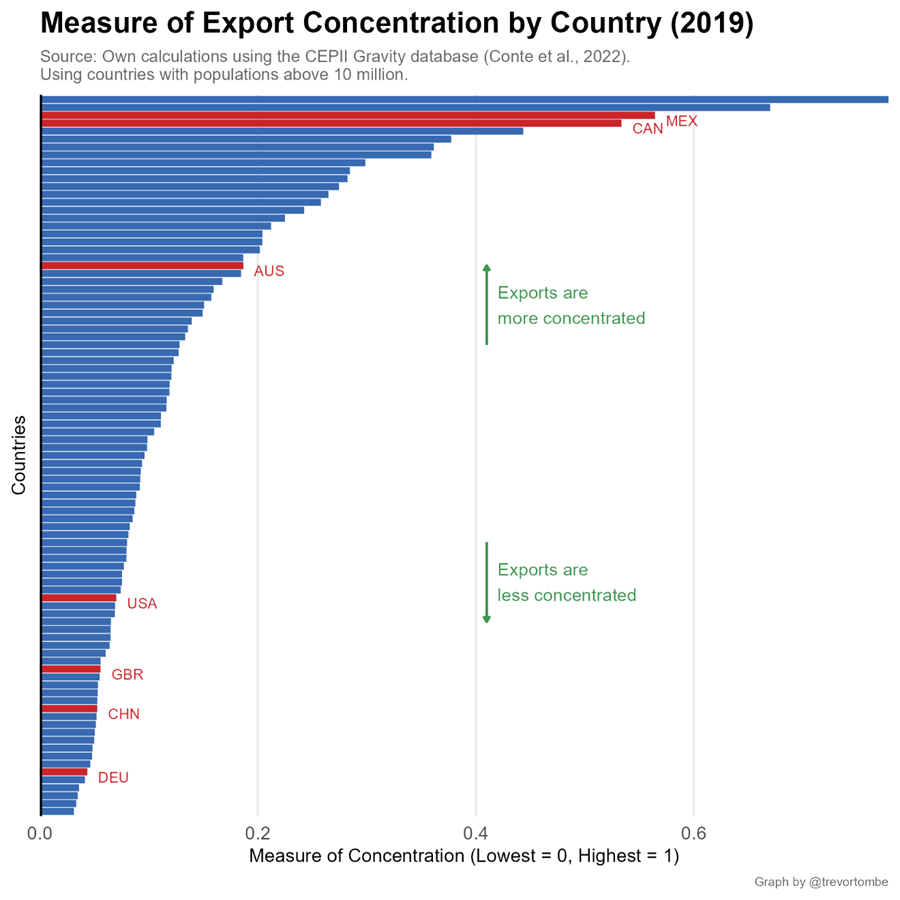

Indeed, Canadian exports are more concentrated than almost any other country on earth. To see this, I illustrate a common measure of concentration below. Among countries with populations above 10 million, only Haiti and South Sudan have more concentrated exports than Canada or Mexico. Among those with 15 million or more, no one else comes close.

Of course, much of this is entirely natural. Countries that are close tend to trade more. And we trade more with large countries than with small ones. From Canada’s perspective, the U.S. is both. Two in three Canadians live within 100 kilometres of the border, for example. And their economy is roughly ten times ours.

Explaining the pattern is easy; managing the risk is hard.

So for this reason alone, Canada should hedge its bets and more aggressively pursue trading arrangements with others. Instead of continuing to resist opening our highly protected and low-productivity sectors—like dairy—we should embrace as many markets as possible. If our leaders have confidence in Canadian producers, easier trade should be nothing to fear.

As an added bonus, easing trade restrictions will lower prices for Canadian families.

We currently maintain an average tariff of nearly 15 percent on agricultural imports, rising to over 243 percent for dairy imports. We even levy a 16.5 percent tax on imported clothing, on average, with significant costs for Canadian families. I estimate taxes on imports cost the average Canadian family approximately $230 per year, and for one in ten families, the costs are more than $500 per year.

Levying new taxes on imports from a friend and ally like the U.K. moves us entirely in the wrong direction.

With so much of our prosperity tied to the U.S. and with so much uncertainty there, eliminating trade barriers with others can’t come soon enough.